Author Archive

Downtrend – October 11th, 2012

The market went into a downtrend yesterday on Wednesday October 10th. We have been through an unusually long uptrend, since June 29th, so a downtrend now was to be expected.

Uptrend – July 2nd, 2012

The markets responded positively to the “solution” to the Euro debt problem and the market model turned to indicate that we are in an uptrend last Friday.

Downtrend – June 25th, 2012

After only three trading days the models switches back to downtrend. Already the day after the model had turned to uptrend we had a massive down day, a sign that highly increased the likelihood that the trend would turn around. The market is turning bearish in front of the European fiscal summit on Thursday, indicating that the market has little belief in any positive resolutions coming out it. I continue to be very negative to the prospects of Europe. Many of the EU countries are in a recession with high unemployment rates, but the major problem is the massive debt levels of EU governments and its financial system. It is a very high likelihood that confidence will evaporate, and the stock market with it. I continue to expect a significant global stock market crash. Although this is almost impossible to time preciously well ahead of time I think it will happen sooner rather than later; likely within the end of 2013.

Uptrend – June 20th, 2012

The market switched to an uptrend today. One of several promising signs is that the market has been going up recently despite negative news. The Fed also announced today that they will extend operation TWIST (replace short-term bonds with longer-term debt) by $267 until year end.

Downtrend – May 5th, 2012

The uptrend that started just a little over a week ago was short lived, and ended officially with the market action yesterday. We are now back in the downtrend again that started on April 11th.

Turn to UPTREND

The market turned to an uptrend with yesterday’s increase in the S&P 500. We usually like to see a higher than 2% increase in the index to indicate high willingness by investors to get back into the market, but still 1.4% with other factors from yesterday’s trade was enough to switch the model to an uptrend.

Market in DOWNTREND – Europe is approaching the point of no return

Lately it has seemed that everything is fine in the world economy. Stock markets have been blazing over the last three months, yields on junk bonds are low, unemployment is falling and the economy is growing. But the underlying structural problems that tell us what is in store for us are not improving one bit. Debt levels are way too high while many of the major collateral classes are falling, or are likely to fall, in value. We are looking at a recipe for another great financial crisis; one that will make the previous crises pale in comparison.

While the uptrend met some resistance a few weeks back, the action since has switched the model to indicate a new DOWNTREND. The model switched last Wednesday and market action since then has confirmed the trend. This has marked the end of an uptrend that started on December 20th. The Chinese market, which has been a leading indicator for years, gave a hint of an imminent top in the US markets as it topped out on February 20th.

It is impossible to say whether this is a start of a steep correction or if it is just a natural breather in a continuing ascent. After the market actions over the last few days it would not be surprising, if it were soon to make a small rebound. But until the market has shown renewed signs of strength and an uptrend is in place again, investors should be careful with their stock holdings. Earnings season has now been kicked off with Alcoa reporting after the close yesterday. The numbers coming in over the coming days and weeks will most likely have a significant saying in the ongoing direction of the market.

The stock market has seemingly been driven by good news over the last three months, but more importantly I think it has been fueled by operation Twist, which has allowed investors to unload long-term treasuries in exchange for cash. And even more significant than the Fed has been the European Central Bank (ECB). Between July 2011 and now, the ECB has expanded its balance sheet by USD 1.3 trillion by handing out USD 645 and USD 712 respectively in its two largest programs called Long Term Refinancing Operation (LTRO) 1 and LTRO 2. Most of this money has been loaned to banks over the last nine months. No wonder that the stock market sees results. The balance sheet of the ECB is a staggering USD 4 trillion, 31% larger than the German GDP!

And this brings us to the crux of the problem: The European debt situation. Many countries and banks in Europe are doomed and the reason remains the same. Loads of bad debt. The issue is highly complex and at the same time very simple. Consumers, banks and countries have taken on too much debt and the financial system is now, and has been for a while, struggling to sustain it. Might sound like a broken record, but unfortunately still way too few people seem to give it the attention it deserves or have tried to understand the implications of the most likely outcomes of this mess.

On April 5th, the day that marked the turn of the model, the German Bundesbank refused to accept Greek, Irish or Portuguese sovereign/bank bonds. Also last week, a 2.6 billion euro Spanish bond auction went worse than expected. Trouble in Euro paradise.

There are so many countries in Europe now, which are in deep trouble due to too much debt combined with contracting economies. The ECB keeps hoping that the situation can be saved, but I believe we are getting closer by the day to the event that will break the system’s back. The main problem is not only the economy in the PIIGS; it is that European banks have a very large exposure to these countries’ debt. In addition to this, banks need to raise significant amounts of capital in the coming years to comply with Basel III and other regulations. The reason why the ECB is taking desperate measures is because the situation calls for it. The European Banking system is over USD 46 trillion in size. EU GDP is in comparison only about USD 16 trillion. The problem is not only the unbelievable size of their assets (remember that bank assets are someone’s debts) but also the banks’ debt levels; according to the IMF their leverage ratio is 26 to 1. This compares to a 13 to 1 ratio for American banks. And we thought American banks were in trouble… Which, by the way they are, it is just that the Europeans have dug a hole that is a little wider and much deeper.

One of the countries that is in trouble is Spain. It is among the ones that stand first in line to fall now after Greece—and do not think for a second that Greece is home free and will not default again, because it will. The country has experienced five straight years of contraction, with a total contraction of 17%; this is by anyone’s definition a depression. It has unemployment above 20% and unfunded liabilities around 800% of GDP.

Spain is in a recession; unemployment has reached a depressing level of 23%. For those under 25 years of age, the unemployment rate is 51%. It will probably not be long until they will take to the streets. But this is likely not the biggest problem. Spain, like so many other western countries, saw its economic growth coming from the expansion of the real estate sector, and since the market turned downwards a few years back, Spanish home prices have fallen only around 15%. Why so little? Because the banks can’t afford lower prices, which would force them to have to write down their balance sheets, which in turn would prove to have devastating effects given the already extreme leverage ratios of Spanish banks. Like the ECB, Spanish banks are hoping for a revival in the economy before they are forced to make these potential write-downs. A revival of an economy, which is already in a recession and with a government with high and growing debt level, who tries to battle their fiscal deficit by reducing it from 8% to 5.5% through cost reduction, is extremely unlikely; especially when you take into consideration that private debt already is at 220% of GDP.

This is the situation in two of the PIIGS countries. The situation in Portugal, Ireland and Italy is dire as well. The problem in Europe is that banks all over the continent have exposure to these economies, which are on the verge of and which should already have declared bankruptcy. And your money is not necessarily safe in the US either; US money market funds have a very large exposure to European debt.

What is the proper thing to do? The answer can be found by looking at what the players who are already in trouble are doing. European banks are rushing into cash. The Wall Street Journal reported on February 21st that eight of the largest banks in Europe were holding a total of USD 815 billion in cash and deposits at central banks at year’s end, up 51% from just one year earlier.

This indicates that banks are very uncertain about the future, or more correctly they fear for their financial future. And if the banking sector is afraid about the future and takes precautionary measures, you can be sure that you should also do so. A follow-on effect of the banks’ action is that less capital is available for lending, translating to less money available for economic growth.

We are in a negative spiral. The problem is just that we have not realized it yet. We are sensing that there are forces in motion; we just don’t know what kind of forces or what direction they are taking. Einstein explained to us that if you are in a windowless vehicle and feel a force pulling down on you, you could be accelerating upward or you could be experiencing the pull of gravity – the two forces are exactly the same. We are in the same situation. We are in a windowless vehicle desperately hoping that our economic theories will be able to predict and manipulate the forces to pull (or push) us in the right direction. Until we realize which forces we are sensing, we are best protected by keeping our savings and investments in cash. Find the safest banks and keep your cash there, for now. If the scenario that I expect unfolds, that will not be safe enough either. You will then have to switch the filling of your mattress.

Austerity measures in Europe, while being the right thing to do, will contrary to many economists and politicians’ beliefs, cause another recession of which no stimulus can save us from. The debt contraction coming in the wake of the recession will lead to a global deflationary depression -not inflation like most people expect. No one will be spared; obviously not Europe, but neither will the US, Japan, Russia, China, Asia in general nor Latin- or South America.

That USD 1+ trillion in ECB handouts is not sufficient and has simply calmed the storm and cause a temporary stock market uptrend. The same will happen with any future efforts of quantitative easing from the ECB or the Fed. The problems we have seen in Greece will spread, and Spain and Portugal are likely next in line. Politicians in Germany, France as well as in the PIIGS countries will have to come back to deal with the bailout problems again and again until they are forced to give up or are voted out of office. And we might see a change in French politics with the election coming up. That would probably just be a good thing. We have been doing nothing than kicking the can down the road ever since the last financial crisis, ensuring that the next crisis will be of a magnitude greater.

It is about time that we all realize that there is nothing wrong with a country declaring bankruptcy. A one-time pain (bankruptcy) is much better than extending the pain over many years (saving a system which is broken due to too much debt by raising more debt) and creating a situation where the outcome will be even more painful that the initial bankruptcy would have been. Bankruptcies of sovereign states is nothing new, or that dramatic. It has happened endless times over the last two centuries and have, all else being equal, never had any long-term negative implications. Investors are quick to forgive and reinitiate lending. Contemporary politicians and economists, all around the world, are still swept in the illusionary belief that financial markets can be manipulated to their whim. This manipulation will continue until they have pushed the system beyond the point of no return, and financial and economic reality has once again had to be relearned—the hard way.

Be aware, the point of no return is fast approaching.

Market in UPTREND – December 21st, 2011

Market made strong headwinds yesterday turning the model to an uptrend signal.

Market in DOWNTREND – November 21st

All eyes are on Europe these days, and for good reason. A spike in bond yields in Spain and Italy Thursday last week continued to fuel contagion worries. In addition bonds in central European countries like France, Belgium, Finland and Austria got unloaded, indicating that investors are starting to discount systemic risk in all EU countries not just the PIIGS. How anyone can believe that the current debt levels and valuations can be sustained continues to amaze me. Market action since early August shows that investors as well are getting increasingly uncertain about the sustainability of our current financial and economic model. To me the main uncertainty when it comes to Europe right now is not if, but when: How long can they keep the illusion alive and which country will leave the Euro first. When the illusion falters, the stock markets will enter a massive crash.

The market has been exceptionally choppy all year and the choppiness increased several-fold after the early August crash, which still holds as the date for the start of a new bear market. The October 27th start of a new uptrend was nothing but a start of a new uptrend, it was rather an indication of an intermediate market top. Not getting follow-through on trend change signals is a sign of a weak market. Since then the market has been just that; with strong selling pressure. NYSE down volume was 93% of total volume last Thursday. Losers led winners by a nearly 9-to-2 ratio on the NYSE and by a 5-to-2 ratio on the Nasdaq. Both indexes failed at breaking above their 200 day moving averages (DMA) and have now fallen below the 50 DMA. The Nasdaq and S&P 500 have fallen below support at 2,600 and 1,220 respectively. In addition the S&P has made five lower highs since its 10/27 top. Top names like Apple and Amazon have also experienced heavy institutional selling—an indication of risk aversion. All contributing to shifting the model to a DOWNTREND. Note that after such intense days of selling it is not unlikely that the market can bounce back for a few days. The next downside support levels for the S&P 500 are at 1,175 and 1,125.

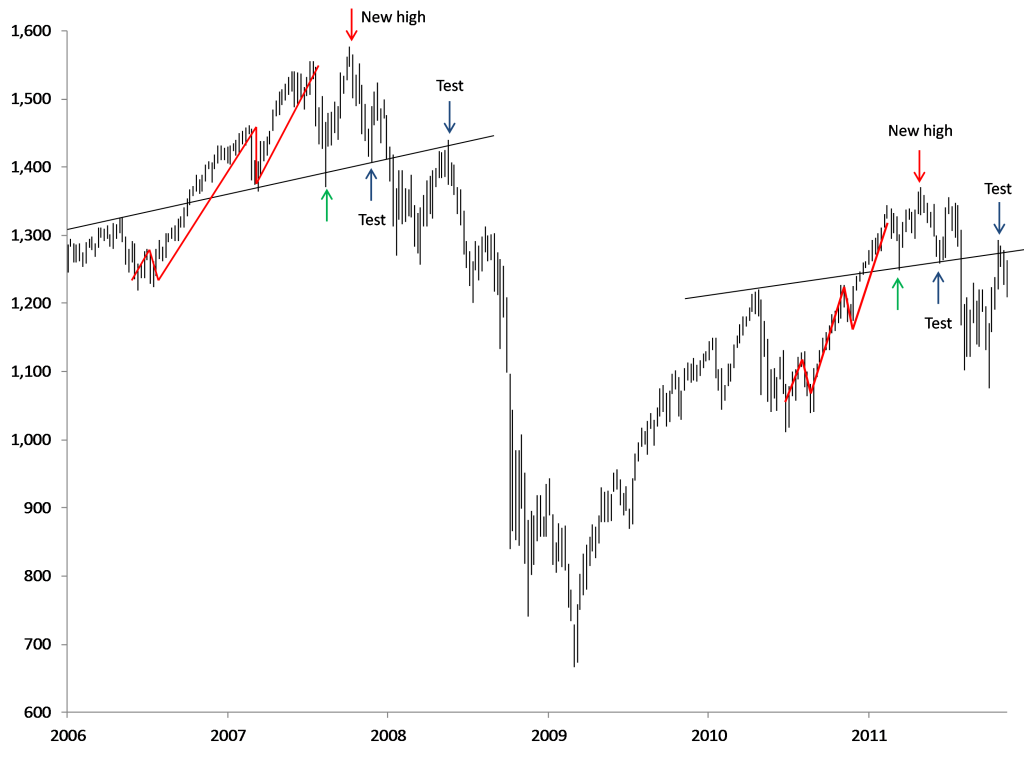

I presented the chart below the first time in the August 7th, 2011 Newsletter. And so far the similarity of the index’s path is striking.

S&P 500 weekly high-low bars

Usually interesting chart patterns like this one does not track for long, but this has now tracked since first half 2010. If it continues to do as well as it has done for about 18 months now, it does not bode well for stock markets going forward and the start of next year will be absolutely devastating. My sincere recommendation since summer to exit your stock portfolios is not at all based on this chart, but I must admit that it is starting to show strong support.

More importantly for that view is that Europe and the US are facing their biggest financial challenges in history now. Much greater than those that led to the financial crisis of 2008, and they are quickly running out of ammunition to deal with it. Ammunition or not, I believe that the situation will not be corrected before we see much more financial suffering in the form of very high inflation or a massive debt deflation. Both will lead to massive inflation adjusted stock market crashes.

China is still a country that many believe will continue to be untouched of the problems in Europe and the US. I however believe that China will see much larger problems than the West; largely due to their own structural challenges. It is getting increasingly difficult for small and medium sized businesses to get credit at banks. Official price inflation is 5.5%, which means that actual price inflation is likely a few percentage points higher and individual savings rates are at 3.5%. This means that Chinese, who have very high savings rates, are seeing their wealth being eroded by inflation. Chinese savers have tried to avoid inflation by investing in real estate which I believe have created a real estate bubble, that could pop at any moment. With only 35% of GDP coming from consumption (compared to 70% in the US) the Chinese economy is still extremely dependent on exports to Europe and the US, which is likely to fall back significantly when eventually the European and US economy starts to slow.

A falling Chinese economy will contribute to ensuring that there is no safety to be found by investing in commodities. Commodity prices as well as silver and gold will together with stocks go down in the coming market crisis. Gold is still the “last man standing.” But remember that gold took its largest hit not in bull years, but in the crash year of 2008. I have earlier suggested that you buy a little gold each month; between 5 and 10% of your net savings depending on how much “insurance” you feel you need. Despite expecting the gold price to fall I continue to suggest that you buy some physical gold each month. Falling prices will just mean that your “insurance policy” will get cheaper. Hopefully you will never have to sell or use that gold you are buying.

In an environment with falling stocks, commodities, precious metals, and most other major asset classes, the one thing going up will be the USD.

Market in UPTREND, October 27th

This will unfortunately be a very short note, because I am out traveling with very limited internet connection. This is a little unfortunate because there is a lot to write about right now, but I will come back with more as soon as I am settled in a location with steady internet access.

The market is acting pretty much according to what I predicted in my last update from September 4th: That after that downturn we entered into that day we would likely get a bounce back maybe as far as into next year. The bounce is what the model confirms right now. The model actually switched to a cash signal right after the market barely undercut its August lows, but in order to keep these email updates at a minimum I decided from the very start that I would not send out notifications of cash signals, only the start of uptrends and downtrends.

The reason why it has taken the model so long now to confirm the recent uptrend is because the bounce have until now been exceptionally weak. The beginning of the move up was strongly influenced by short covering. The bounce has furthermore been led by companies that have been underperforming in the last years uptrend, and it has gone up on very low volumes. The market has anticipated a resolution of the Greek debt crisis, which is actually more correctly a European banking crisis. How long this uptrend will last and how high it will go will depends on governments’ and central banks’ willingness to print money.

This last resolution of the European debt problem came by finally accepting that private lenders had to take a write-down on Greek debt, which is the same as a the Greek government defaulting on its debt obligations, which I for a long time have written in these newsletters is an inevitable outcome. In the newsletter from June 3rd, 2010 I for instance wrote that “…Greece will probably not be able to meet the requirements set by the ECB and IMF, and go bankrupt soon…” Very few people agreed with me on this prediction and actually just until very recently did this become apparent to most market participants. The reason why this, in my mind, has been obvious and inevitable is because this is a systemic crisis that will not be fixed until we correct the underlying factors which make the whole global system unsustainable. Those factors include too high budget deficits, too high debt levels, including private-, corporate- and public- debt, and a chronic tendency over the last four decades to revert to money printing for any little bump we have met in the road.

The recent effort from European officials is once again an effort to solve a problem of too much debt with adding more debt. They are in addition forcing private investors to take a 50% write-down of their Greek debt positions. This is not going to do anything but buy us a little bit more time and cause the stock market to go a little higher, due to massive capital injections from UK and Europe, before the eventual, unavoidable, massive crash comes. This last “solution” will, as all other attempts in Europe, Asia and the Americas, in addition only make the inevitable crash deeper.

After this write-down, Greek debt to GDP ratio is still at 130%, way too high to handle for a country with a contracting economy. The Greek economy is so insanely poorly managed that I cannot come up with a single viable solution besides a full-blown default and ensuing depression that can get that society back to a state were rational economic thinking once again exists. Read Michael Lewis’ Boomerang: Travels in the New Third World for an exceptionally well written take on some of the reasons why Greece is where it is today and its challenges going forward.

If you think that Greece is a stand-alone case in Europe, you are wrong. The reason why Greece is being bailed out is not because Germany feels sorry for their fellow Europeans; it is because the rest of the European banking system is in just as bad a shape as Greece, and Greece was the domino that would make the whole system collapse. In an effort, it seems more to calm the public than anyone else, 90 European banks went through a stress test during the summer 2011. These 90 banks need to repay or refinance €4.8 trillion worth of debt between 2011 and 2013. This equals 51% of Eurozone GDP. In France, Italy and Germany the two largest banks alone need to find financing for amounts equal to 6, 9 and 17% of national GDP, respectively, in the same time-period. I don’t think I am even close to sticking out my head by saying that this amount of debt will never be refinanced—at least not in an un-depreciated currency. European banks are in addition, according to Graham Summer, leveraged 26 to 1, which is close to the same level as Lehman was just before it collapsed. U.S. banks are in comparison leveraged 13 to 1. This last effort from European governments to try to establish trust in the financial system will, like previous efforts, evaporate very soon. Hardly any amount of government intervention will be large enough to create stability in Europe by this point.

So in order to protect your wealth, you should, as I also mentioned in my last update, use this uptrend to exit your stock market positions because when the rest of the investment world as well starts to realize that what the governments are trying to do right now by “shoring up the financial system” will never succeed, the stock market crash will be fast and furious, and by that time, whenever it will happen, you will be very glad that you are far out of the stock market with your savings.