Posts Tagged ‘technical analysis’

Market in DOWNTREND – November 21st

All eyes are on Europe these days, and for good reason. A spike in bond yields in Spain and Italy Thursday last week continued to fuel contagion worries. In addition bonds in central European countries like France, Belgium, Finland and Austria got unloaded, indicating that investors are starting to discount systemic risk in all EU countries not just the PIIGS. How anyone can believe that the current debt levels and valuations can be sustained continues to amaze me. Market action since early August shows that investors as well are getting increasingly uncertain about the sustainability of our current financial and economic model. To me the main uncertainty when it comes to Europe right now is not if, but when: How long can they keep the illusion alive and which country will leave the Euro first. When the illusion falters, the stock markets will enter a massive crash.

The market has been exceptionally choppy all year and the choppiness increased several-fold after the early August crash, which still holds as the date for the start of a new bear market. The October 27th start of a new uptrend was nothing but a start of a new uptrend, it was rather an indication of an intermediate market top. Not getting follow-through on trend change signals is a sign of a weak market. Since then the market has been just that; with strong selling pressure. NYSE down volume was 93% of total volume last Thursday. Losers led winners by a nearly 9-to-2 ratio on the NYSE and by a 5-to-2 ratio on the Nasdaq. Both indexes failed at breaking above their 200 day moving averages (DMA) and have now fallen below the 50 DMA. The Nasdaq and S&P 500 have fallen below support at 2,600 and 1,220 respectively. In addition the S&P has made five lower highs since its 10/27 top. Top names like Apple and Amazon have also experienced heavy institutional selling—an indication of risk aversion. All contributing to shifting the model to a DOWNTREND. Note that after such intense days of selling it is not unlikely that the market can bounce back for a few days. The next downside support levels for the S&P 500 are at 1,175 and 1,125.

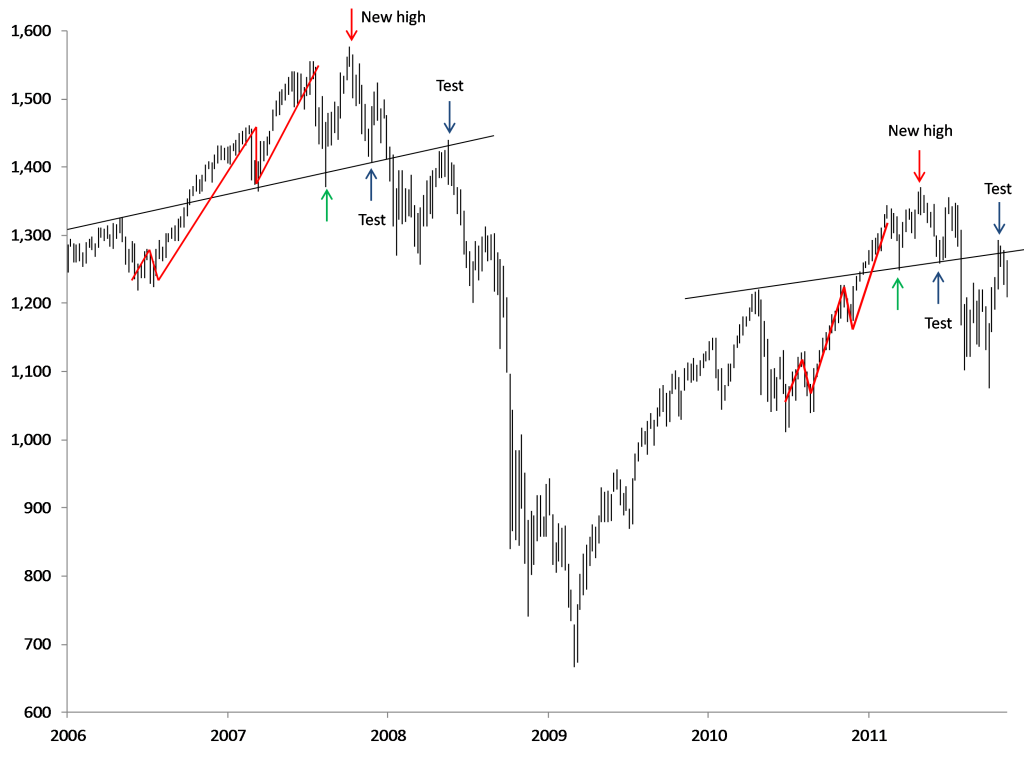

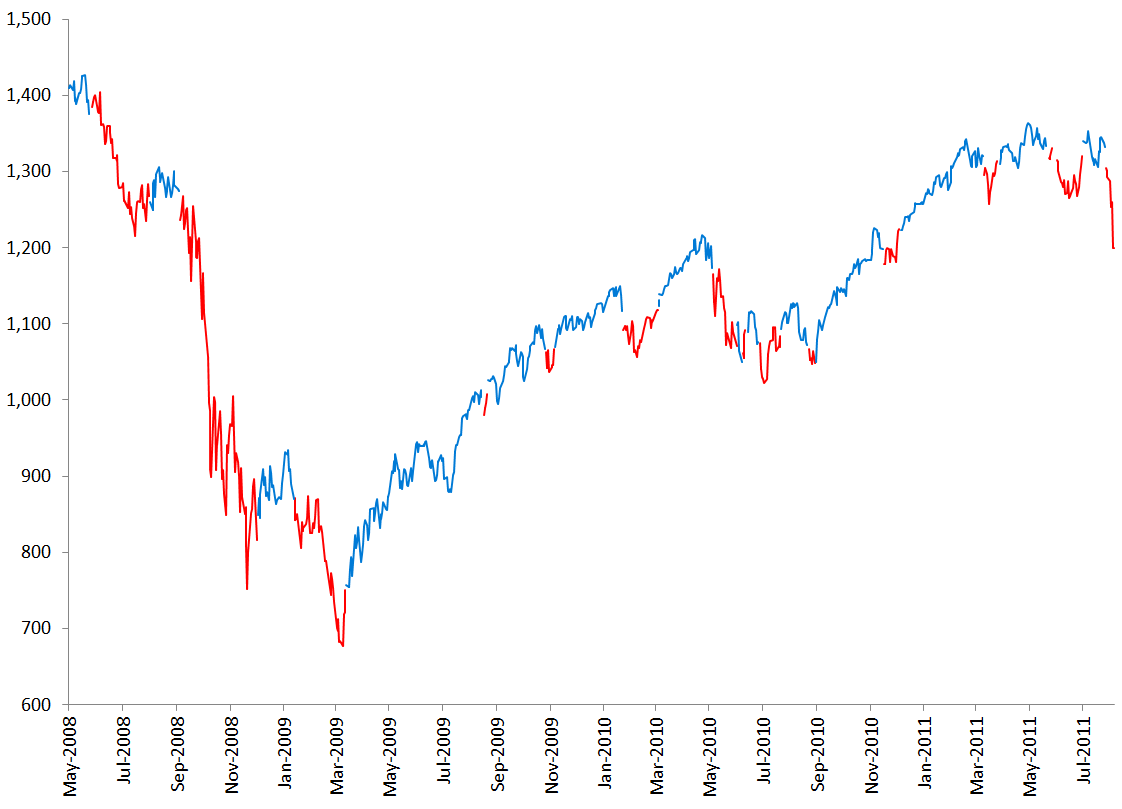

I presented the chart below the first time in the August 7th, 2011 Newsletter. And so far the similarity of the index’s path is striking.

S&P 500 weekly high-low bars

Usually interesting chart patterns like this one does not track for long, but this has now tracked since first half 2010. If it continues to do as well as it has done for about 18 months now, it does not bode well for stock markets going forward and the start of next year will be absolutely devastating. My sincere recommendation since summer to exit your stock portfolios is not at all based on this chart, but I must admit that it is starting to show strong support.

More importantly for that view is that Europe and the US are facing their biggest financial challenges in history now. Much greater than those that led to the financial crisis of 2008, and they are quickly running out of ammunition to deal with it. Ammunition or not, I believe that the situation will not be corrected before we see much more financial suffering in the form of very high inflation or a massive debt deflation. Both will lead to massive inflation adjusted stock market crashes.

China is still a country that many believe will continue to be untouched of the problems in Europe and the US. I however believe that China will see much larger problems than the West; largely due to their own structural challenges. It is getting increasingly difficult for small and medium sized businesses to get credit at banks. Official price inflation is 5.5%, which means that actual price inflation is likely a few percentage points higher and individual savings rates are at 3.5%. This means that Chinese, who have very high savings rates, are seeing their wealth being eroded by inflation. Chinese savers have tried to avoid inflation by investing in real estate which I believe have created a real estate bubble, that could pop at any moment. With only 35% of GDP coming from consumption (compared to 70% in the US) the Chinese economy is still extremely dependent on exports to Europe and the US, which is likely to fall back significantly when eventually the European and US economy starts to slow.

A falling Chinese economy will contribute to ensuring that there is no safety to be found by investing in commodities. Commodity prices as well as silver and gold will together with stocks go down in the coming market crisis. Gold is still the “last man standing.” But remember that gold took its largest hit not in bull years, but in the crash year of 2008. I have earlier suggested that you buy a little gold each month; between 5 and 10% of your net savings depending on how much “insurance” you feel you need. Despite expecting the gold price to fall I continue to suggest that you buy some physical gold each month. Falling prices will just mean that your “insurance policy” will get cheaper. Hopefully you will never have to sell or use that gold you are buying.

In an environment with falling stocks, commodities, precious metals, and most other major asset classes, the one thing going up will be the USD.

Market in DOWNTREND, September 4th

The model switched back to downtrend last Friday September 2nd. For those of you who are new to this model, that means that you do not want to own or buy shares. The odds are stacked against the bulls right now and chances are much higher that you will make money shorting the market. Since the crash in August, all signals seem to indicate that the bull market that we have been in since March 2009 has ended, and that we are entering another bear market. That again means that you should be doubly cautious owning stocks.

The jobs report that came in on Friday added zero jobs, a negative since we need at least 125,000 jobs a month just to keep up with population growth. Over the last three months the official numbers have furthermore been revised down 58,000. The national manufacturing activity report from the Institute of Supply Management (ISM) came out Thursday at 50.6, which is just a tad above a contraction. This was the third straight month in which inventories rose more than new orders.

The business outlook survey (BOS) from the Philadelphia Fed does not look much better (chart below). The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a slightly positive reading of 3.2 in July to -30.7 in August. The index is now at its lowest level since March 2009.

The last two times the index reached -20 or lower, in January 2001 and August 2008, the stock market responded with crashes. In 2001 the market corrected 41% until its bottom on October 10th, 2002. After the second low reading in August 2008 the market fell 45% until its low in March 2009. You should off course not base your investment decisions on just a few observations, but the ISM and the BOS are both very good starting points. Take also another look at the other data points from my previous post which also indicate that we are heading towards a new economic recession.

Based on my reading of the market at this juncture; the risk reward in stocks is not favoring long-term holders. For those of you with a 401(k) or any other savings in the stock market for that matter, you should strongly consider exiting those investments now and moving into cash. Cash, you might say, offers no yield, why would you want to invest in that? I think we are heading into an era when you will be happy by loosing as little as possible and were everything will be about relative returns. If the stock market falls 50% and you have kept your savings in cash, your purchasing power in terms of stocks has just doubled! Same goes with any other asset class that deflates relative to cash. I believe that the purchasing power of your cash will increase relative to almost all asset classes over the coming years, if this is in fact, which it seems to be, the start of a new bear market.

Market timing is extremely difficult. Hitting the exact top or bottom is for all practical purposes impossible, but still many investors are extremely hesitant to exit their positions if their portfolio is lower than it was at the top. Here is a story that can illustrate this behavior (the story is from William O’Neil’s excellent book How to Make Money in Stocks):

“A little boy was walking down the road when he came upon an old man trying to catch wild turkeys. The man had a turkey trap, a crude device consisting of a big box with the door hinged at the top. This door was kept open by a prop to which was tied a piece of twine leading back a hundred feet or more to the operator. A thin trail of corn scattered along a path lured turkeys to the box. Once inside, the turkeys found an even more plentiful supply of corn. When enough turkeys had wandered inside the box, the old man would jerk away the prop and let the door fall shut. Having once shut the door, he couldn’t open it again without going up to the box and this would scare away any turkeys lurking outside. The time to pull away the prop was when as many turkeys were inside as one could reasonably expect. One day he had a dozen turkeys in his box. Then one sauntered out, leaving 11. “Gosh, I wish I had pulled the string when all 12 were there,” said the old man. “I’ll wait a minute and maybe the other one will go back.” While he waited for the twelfth turkey to return, two more walked out on him. “I should have been satisfied with 11,” the trapper said. “Just as soon as I get one more back, I’ll pull the string.” Three more walked out, and still the man waited. Having once had 12 turkeys, he disliked going home with less than eight. He couldn’t give up the idea that some of the original turkeys would return. When finally only one turkey was left in the trap, he said, “I’ll wait until he walks out or another goes in, and then I’ll quit.” The solitary turkey went to join the others, and the man returned empty-handed. The psychology of the normal investor is not much different. They hope more turkeys will return to the box when they should fear that all will walk out and they’ll be left with nothing.”

This is the type of stock market that we have likely entered into. It is a big likelihood that those of you waiting to get 12 or 13 turkeys now will have to wait for a decade or longer and in the meantime see your portfolios halve or worse (this off course could change if the Fed decides to print a few more trillion USDs). So how should you exit your investments? I would say for most people the best thing is to just get out and be over with it. But if you are not following my model and feel some resemblance to the old turkey hunter in the way that you would be unwary if the stock market was to recover towards the end of the year, I would recommend that you exit your portfolio over time. One way to do this would be to exit your portfolio in equal portions over a fixed time period. Let’s say that you decide to start exiting this week and want to be fully out by the end of the year. There are 17 weeks left of the year, which means that you would exit your portfolio in 17 equal portions until the last week of the year. Assuming that you have a total of 10,000 shares/units, it could for example mean that you would sell 590 shares once a week the next 16 weeks and then 560 shares the last week of December. The length of your period should be whatever you are comfortable with and depending on how long you think a potential bear market rally will last. If you think that this is just another correction in the bull market from March 2009, then you should sit tight and wait for another uptrend signal.

Below is an updated version of the chart that I posted in the newsletter from August 7th.

S&P 500 weekly high-low bars

The last uptrend was not able to push the index upwards to the resistance level. I will continue to update this chart regularly going forward. I would not be surprised to see this downtrend or the next one push the indexes below the August lows. Markets typically correct between 40-60% in bear market rallies so if we see a new low in September it would be normal to see such a rally last maybe towards the end of the year. Remember that this is rough estimates based on how the markets look today. It could change on very short notice. You will be much better off by following the signals of the model than to try to guestimate what the markets might or might not do in the future.

You will find the performance of the model by following the link here.